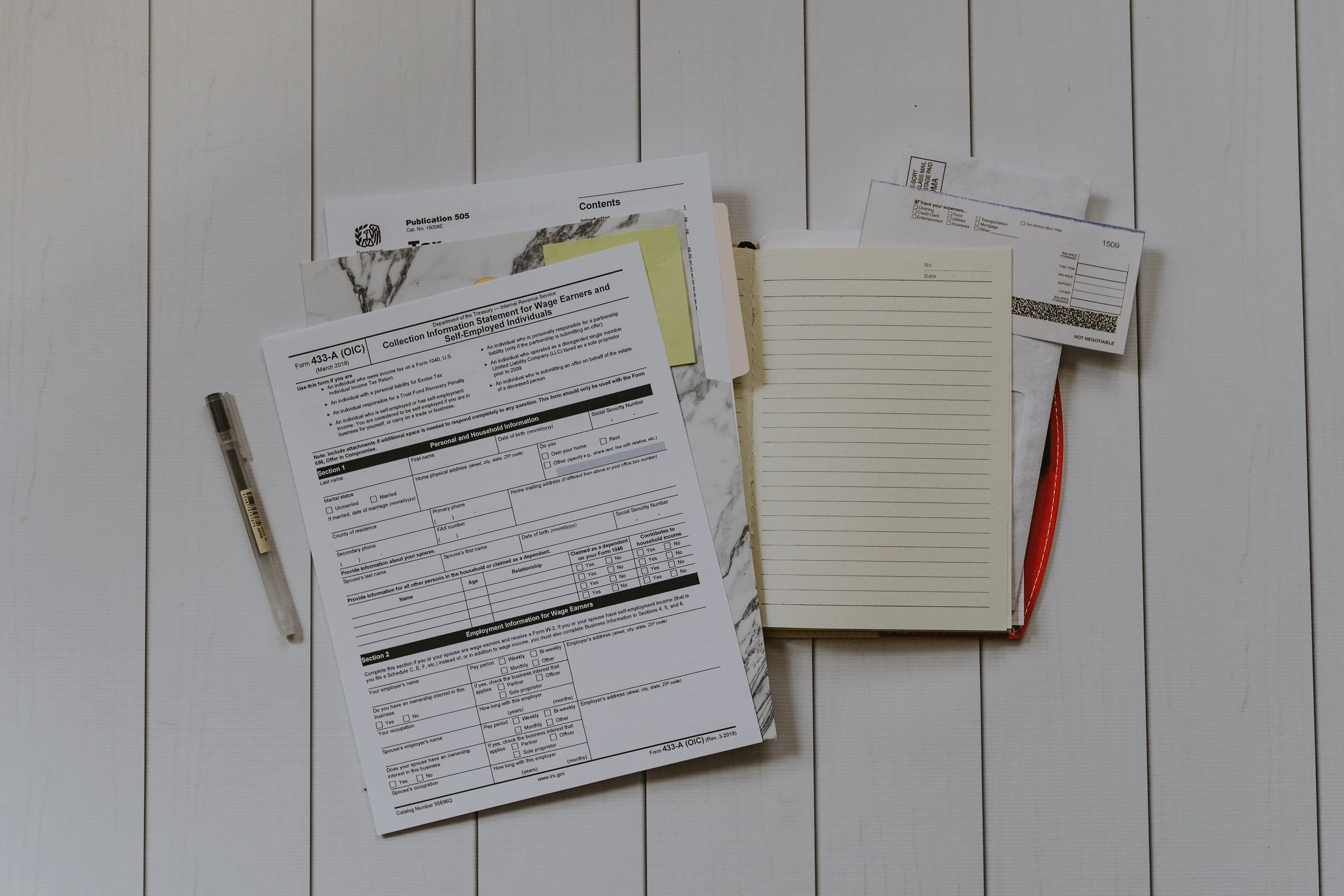

Your Mortgage Application Checklist

Every lender requires documents as part of the process of approving a mortgage loan. Here are documents you're generally required to provide:

W-2 Tax Returns

W-2 tax returns or business tax returns if you’re self employed - for the last two or three years for every person signing the loan.

Pay Stubs

At least one pay stub for each person signing the loan.

Credit Card Account Numbers

Account numbers of all of your credit cards and the amounts for any outstanding balance.

Bank Statements

Two to four months of bank or credit union statements for both checking and savings accounts

Installment Loans

Lender, loan number, and amount owed on installment loans, such as student loans and car loans

Addresses

Addresses where you lived for the last five to seven years, with names of landlords if appropriate

Brokerage Statements

Brokerage account statements for two to four months, as well as a list of any other major assets of value, such as a boat, RV, or stocks or bonds not held in a brokerage account.

401(k)

Your most recent 401(k) or other retirement account statement.

Income

Documentation to verify additional income, such as child support or a pension.

Source: National Association of REALTORS, REALTOR Magazine.